Final Expense Coverage

A lasting gift of care and peace of mind.

No one likes to think about the end of life, but planning for it is one of the most loving things you can do. At Low-Cost Health Coverage, we offer Final Expense Coverage designed to ease the financial burden on your loved ones when it matters most.

In partnership with Impact Health Sharing, we provide a complete solution: affordable care while you're living, and meaningful protection after you're gone. Together, we help you leave behind peace of mind, not bills or worry.

What is final expense coverage?

Final expense insurance is a small, straightforward life insurance policy that’s designed to cover funeral and burial costs, medical bills, and other expenses left behind. Unlike traditional life insurance, it’s more affordable, easier to qualify for, and provides quick financial relief when it’s needed most.

Your family can use the funds for:

Funeral or cremation services.

Caskets, headstones, or urns.

Unpaid medical or utility bills.

Travel for out-of-town family.

Legal or probate costs.

Any other personal expenses.

*You’re not just planning for a day in the future; you’re giving your loved ones the ability to say goodbye without added financial burden.

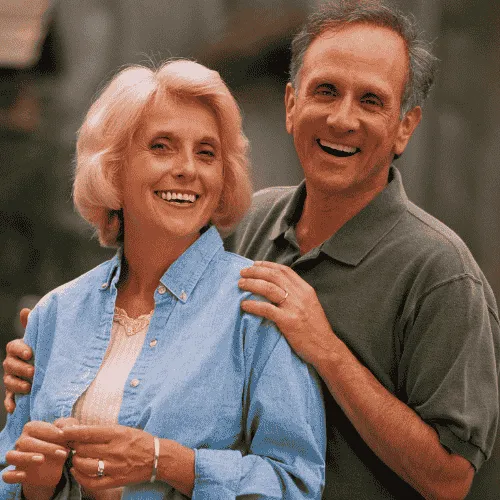

Who should consider final expense coverage?

This coverage is ideal for:

Seniors and retirees who want to protect their families from funeral costs

Adults planning ahead to leave a lasting, stress-free legacy.

People with health conditions who may not qualify for traditional life insurance.

Families who want affordable coverage without large premiums or complicated terms.

Final expense coverage includes:

Guaranteed approval options

Many plans require no medical exam and have guaranteed acceptance for ages 50 to 85, even if you have health conditions.

Flexible coverage amounts

Choose from coverage options starting at $5,000 up to $25,000, based on your needs and what you want to leave behind.

Fast payouts when it matters most

Your family typically receives the benefit within days, helping them cover urgent costs without stress or delays.

Locked-in rates

Your monthly premium is fixed for life. It will never go up, and your coverage will never decrease, regardless of age or changes in health.

Use funds any way they need

Choose from coverage options starting at $5,000 up to $25,000, based on your needs and what you want to leave behind.

Leave love, not bills

Get affordable protection that covers funeral costs and more.

How does final expense coverage complement Impact Health Sharing?

Impact Health Sharing helps you save money on medical care while you're alive, but it doesn't cover funeral costs or provide a death benefit. That’s where Final Expense Coverage from Low-Cost Health Coverage comes in. Together, they give you complete support for life and beyond.

Here’s how they work together:

Covers what Health Sharing doesn’t

Impact helps with doctor visits, hospital stays, and more, but it doesn't pay for funeral or burial costs.

Final Expense Coverage fills that gap, helping your family cover funeral services, travel, and last bills, without financial stress.

Gives families space to grieve

In hard times, the last thing your loved ones need is a big bill.

This plan gives them the space to mourn and remember you, without worrying about how to pay for it all.

Together, they cover every stage

Health sharing supports your care while you’re living. Final Expense Coverage takes care of the end.

Together, they form a full-circle solution that protects you now and supports your family later.

Built on shared values

Both Impact and Low-Cost Health Coverage put people first.

With both plans, you get honest, affordable coverage that honors your health, your values, and your family.

Your trusted partner for life’s health decisions

Chat with us

Live chat is currently unavailable.

Please check back soon or give us a call for immediate assistance.

Call us

Call 1-818-481-9342 / TTY 711

Hours: 8 a.m. to 8 p.m., 7 days a week.

FOLLOW US

COMPANY

CUSTOMER CARE

LEGAL

Copyright 2026. Low Cost Health Coverage. All Rights Reserved.